You’ve probably heard that next to buying a home, getting a new or pre-owned vehicle is one of the largest purchases one can make.

You’ve probably heard that next to buying a home, getting a new or pre-owned vehicle is one of the largest purchases one can make.

You may also be aware that factors to get financing in both homes and cars rely in some part on a credit score, or FICO Score. According to the Fair Isaac Corporation (FICO), which calculates these scores, “90% of top lenders use FICO Scores” in their lending process.

While the overall FICO Credit Score numbers typically range from 300 to 850, when it comes to buying a car, you may wonder what the minimum score is to get an automobile loan. And like many things, that answer can vary based on different information.

According to Car and Driver, “Most used auto loans go to borrowers with minimum credit scores of at least 675. For new auto loans, most borrowers have scores of around 730. The minimum credit score needed for a new car may be around 600, but those with excellent credit often get lower rates and lower monthly payments.”

How credit scores affect car loans

Auto finance lenders use a credit score and credit data in your credit report, plus other sources and factors, to evaluate loan applications. Things such as previous payment history, income and employment history all can play a part in determining credit availability.

The credit score and these reports play a big role in determining whether a consumer is approved for an auto loan, and, if so, what interest rate they will receive. Typically, the higher the credit score, the better the interest rate.

However, since every person’s situation is unique, one’s specific credit score and credit reports can affect car loans in vastly different ways.

Car loan rates by credit scores

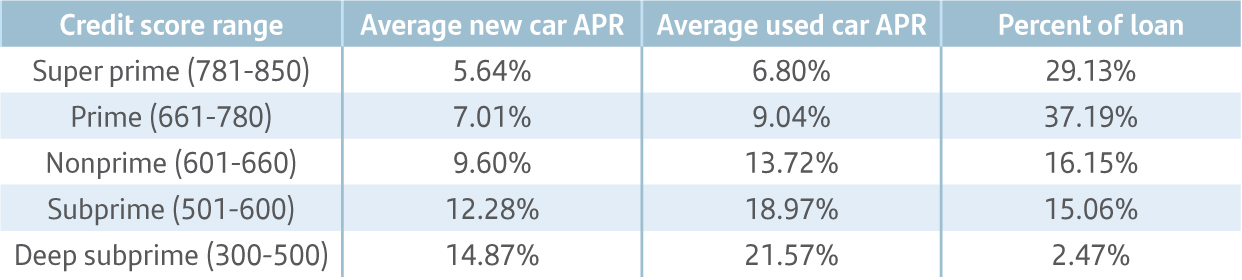

So just how are auto loan interest rates tied to credit scores and where do the numbers come into play? According to Experian’s State of the Automotive Finance Market Report, close to a third of borrowers fall in the super prime credit category, while over 17% fall in the subprime and deep subprime categories.

The chart below shows the average Annual Percentage Rate (APR) for new and used vehicles in relation to the credit score category. (Rates as of Q1 2024, published May 30, 2024.)

Steps to improve your credit score before applying for a car loan

If you currently have a low credit score, the good news is that there are ways that can potentially improve your number before you apply for an auto loan.

These include:

- Paying bills on time

- Checking your credit reports and clearing up past-due amounts

- Disputing any errors found on your credit reports

- Applying only for the credit you need

- Leaving unused credit cards open

- Keeping credit card balances low and paying down debt

Keeping a close eye on your credit score and personal finances can go a long way in possibly setting you up for loans in the future. And how do you keep up with your credit score? We’re glad you asked.

How to check your credit score for free

To find out your current credit score and see if there are any past-due amounts or errors that need addressing (as mentioned above), you can check your score through the three credit reporting bureaus — Equifax, Experian and TransUnion. You are entitled to request your credit reports from each of these free of charge once a year.

To request your reports, call 877-322-8228, go online at www.annualcreditreport.com.

For more information on when you should check your credit report, read the article here.

How to get a car loan with subprime credit

If you currently have a deep subprime score (range 300-500) and little time to improve your credit before needing a new vehicle, there are some things that may help you get a car loan.

A few things that can help in the process are:

- Put more money down to lower your loan amount.

- Trade in a vehicle to put toward the new one.

- Involve a co-applicant to go in on the loan with you. Applying with a co-applicant who has a prime credit score, if approved, can possibly help get a car loan with better terms.

- Consider buying a used over new vehicle and an older model rather than later one.

Can I repair my credit and boost my credit score?

If you do have a subprime credit score, one way that can lift the score and repair any past credit hits that have occurred can be through credit repair companies. As this article on What is credit repair and how does it work? explains, “Credit repair companies offer coaching for debtors looking to improve their credit by providing guidance on how to pay off their debts, along with their aims for positive impact on their credit scores.”

Make sure you do your research on a potential credit repair company, including what charges they may assess, and read their reviews to gain more insight. Good places to start are Google reviews or the Better Business Bureau (BBB).

We’re here to help

No matter your credit score, when you’re ready to see if you pre-qualify for a new vehicle, our team at Drive® can help you. The process takes two minutes and gives you real-time rates.

And speaking of credit scores, using the Drive pre-qualify process has no impact to your credit score, so feel free to get started today.

*The statements in this article are informational only and should not be construed as legal, financial, tax or other professional advice.